Understanding the Republican Tax Code Transformation

The Republican Party has significantly influenced the U.S. tax code, setting the stage for one of the most extensive transformations in recent history. With the 2017 Tax Cuts and Jobs Act, the groundwork was laid for changes that fundamentally altered the way Americans approach tax and spending. Understanding this re-engineering process is essential for navigating today’s economic landscape.

Historical Context of Tax Reform

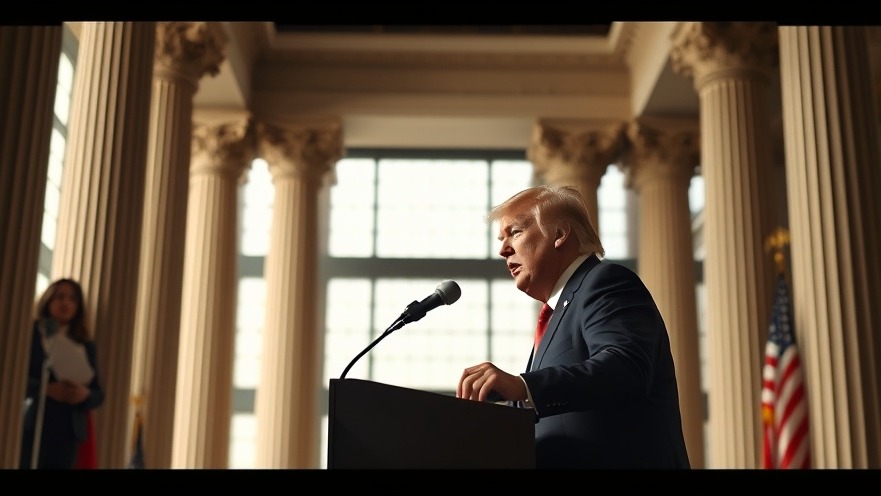

The roots of the current tax code transformations date back decades, with various administrations striving to tackle the problems of inequality, revenue generation, and economic stimulus. Historically, Republican tax policy has aimed to lower taxes for businesses and wealthy individuals while promoting the idea that this approach will ultimately benefit all levels of society. For many, the significant reductions in corporate tax rates during the Trump administration were seen as a way to catalyze economic growth, albeit with varying opinions on its effectiveness.

The Economic Implications of Tax Cuts

Proponents argue that tax cuts stimulate investment and job creation, providing a much-needed boost to the national economy. However, critics caution that these cuts disproportionately benefit the wealthy and add to the national deficit. A closer look reveals that while stock markets boomed post-reform, the promised trickle-down effects may not be reaching the broader populace as anticipated. Current inflation rates and rising unemployment figures further complicate this narrative, revealing the consequences of these fiscal decisions.

Social Reactions and Political Ramifications

As Americans navigate increased living costs and economic uncertainty, public opinion on tax reforms has become increasingly polarized. Many citizens remain concerned about mounting national debt and potential cuts to public services, leading to questions about the long-term sustainability of such tax policies. Political actors are split, with Republicans often touting the benefits of their changes while Democrats highlight social justice and financial equality concerns.

Future Predictions: What's Next for the Tax Code?

Looking toward the future, the landscape of federal taxation may be poised for further transformation, particularly as we approach the 2024 elections. The Biden administration has hinted at measures to counterbalance the wealth inequalities exacerbated by previous tax cuts. This potential for change could signify a re-engagement in tax reform debates, focusing on fair taxation principles and fiscal responsibility. Additionally, significant discussions surrounding climate change and environmental policy could reshape tax incentives to promote sustainable practices, with possible focus on renewable energy.

Real-Life Impact: How This Affects the Average American

The ongoing evolution of the tax code doesn’t just impact big businesses and the wealthy; the average American feels these changes in their daily lives. From potential tax refund size to the likelihood of state funding for schools or infrastructure projects, each modification generates ripples throughout local communities. Understanding these dynamics empowers citizens to engage more actively in local politics and advocate for policies that reflect their needs—be it in education, healthcare, or public safety.

Emotional Considerations and Human Stories

Consider the stories of average citizens experiencing the ramifications of tax reengineering. For many, adjustments in training and education funding directly affect job opportunities and earning potential. Moreover, the burden of rising living costs amid a changing tax framework can lead to emotional stress and uncertainty, raising broader questions about fairness and opportunity in the American socio-economic landscape.

Take Action: Engage with Local Political Processes

As the debate around tax policy continues, it is essential for individuals to take advantage of opportunities to engage in political processes, whether through local town hall meetings, electoral participation, or advocacy groups. Knowledge of the tax system not only informs personal finance decisions but also empowers voters to push for systemic change that accurately reflects community needs.

Add Element

Add Element  Add Row

Add Row

Add Row

Add Row  Add

Add

Write A Comment