Revolutionizing the Tax Code: A Populist Shift

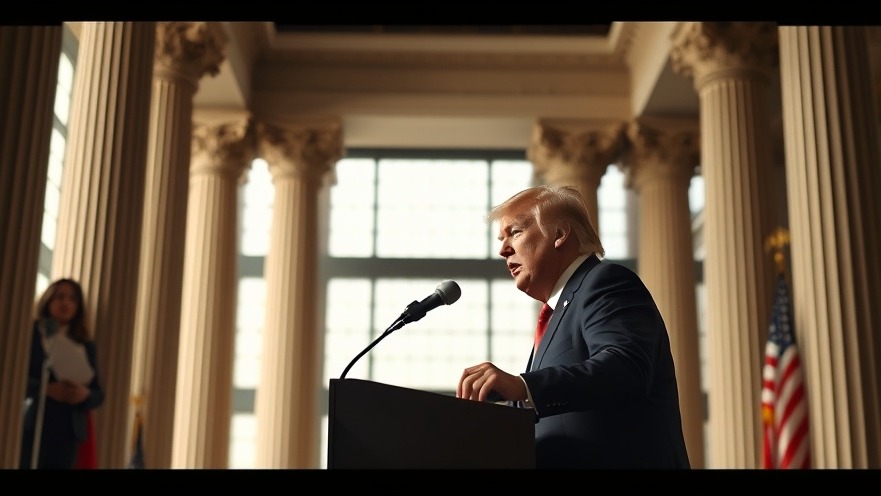

As the United States grapples with a shifting political landscape, the Republican Party has undertaken a pivotal transformation of the nation’s tax code. A potent blend of traditional conservative principles and President Trump’s populist rhetoric has reshaped the way taxes will be collected in the foreseeable future. This re-engineering, marked by its execution during a campaign and an emphasis on immediate, tangible benefits for everyday Americans, signifies a departure from the complex legislative processes of yesteryears.

The Backstory: From Cafeteria to Capitol Hill

In years past, significant tax legislation flowed from the meticulous calculations of Washington think tanks and corporate accountants. Republican leaders invested time and effort into a detailed re-examination of the tax code, culminating in the Tax Cuts and Jobs Act of 2017. Those changes, grounded in supply-side economics aimed at stimulating growth through lower corporate rates, departed from the repackaged populism now resonating widely.

This time, however, a waitress at the Las Vegas hotel owned by Trump served as the catalyst for change. Citing her frustrations over being taxed on tips during the 2024 campaign, Trump captured the attention of Congress, leading to a new exemption for tipped income—a move that aligns closely with his goal of regaining favor with working-class voters, particularly in key battleground states.

Populism Meets Traditional Conservatism

The recent tax bill embodies this merging of populism and tradition, reflecting a broader narrative of accessibility over complexity. Rather than initiating sweeping reforms with a broad brush, the Republicans are now functioning at a micro-level, implementing smaller, yet significant, changes aimed at direct impact. Changes include exemptions for various worker categories, a departure from the past overarching reduction strategies. It's a nod to Trump’s campaign philosophy, which prioritized relatable, grassroots storytelling above comprehensive planning.

Future Insights: Implications for the American Economy

The long-term implications of this populist approach to tax reform could be vast and unpredictable. On one hand, tax cuts that target specific sectors, like service industry workers, could invigorate local economies, promote consumer spending, and potentially reduce job-related burdens for millions of Americans. On the other hand, such temporary cuts might lead to instability and complicate the overall structure of the tax system, especially with the potential for increased scrutiny from political opponents who favor a more unionized and structured approach to tax reform.

Broader Political Trends and Reactions

The implications extend beyond taxes. This bold pivot may resonate with an electorate increasingly disenchanted with establishment politics. Critics, however, warn against the regression to populist promises that often prioritize immediate political gains over sustainable economic growth plans. The risks of this strategy extend to potential economic instability, as piecemeal reforms could lead to complications in budget balancing and revenue generation in the long run.

What This Means for Voters Across the Nation

The summation of these new tax policies ultimately impacts the daily lives of citizens. As it stands, voters may feel more empowered by a system that appears to account for their unique situations rather than an overarching policy that benefits corporate America. The popularity of isolated tax cuts suggests a national yearning for immediate financial relief and functional government responsiveness.

As midterm elections loom, this tax code re-engineering may play a pivotal role in shaping voter sentiment across the nation. The messaging from Republicans is clear: they are listening to average Americans and addressing their concerns. For voters worried about inflation and economic strain, the immediacy of these policies could be a compelling reason to rally behind their new tax agenda.

In conclusion, the significant shifts in tax policy reflect a larger trend within the Republican Party—a departure from traditional conservative ideals in favor of populist approaches. For constituents who demand immediate relief and representation, this new direction could signal the dawn of a new era in American politics, where the voices of everyday citizens are heard within the halls of power.

Add Element

Add Element  Add Row

Add Row

Add Row

Add Row  Add

Add

Write A Comment